Is this a fake recovery or a real one? That’s the question.

The second quarter of 2019 was probably an odd one because the new transfer and mansion tax rates kicked in starting July 1st, which means there are now higher closing costs for buyers of luxury properties. It follows that there was a rush to buy this kind of properties before the July 1st deadline.

This specific incentive is now over, so let’s see what happens. For example the number of transactions for properties in the $2 to $5 million dollar range surged a whopping 36% YoY (year over year).

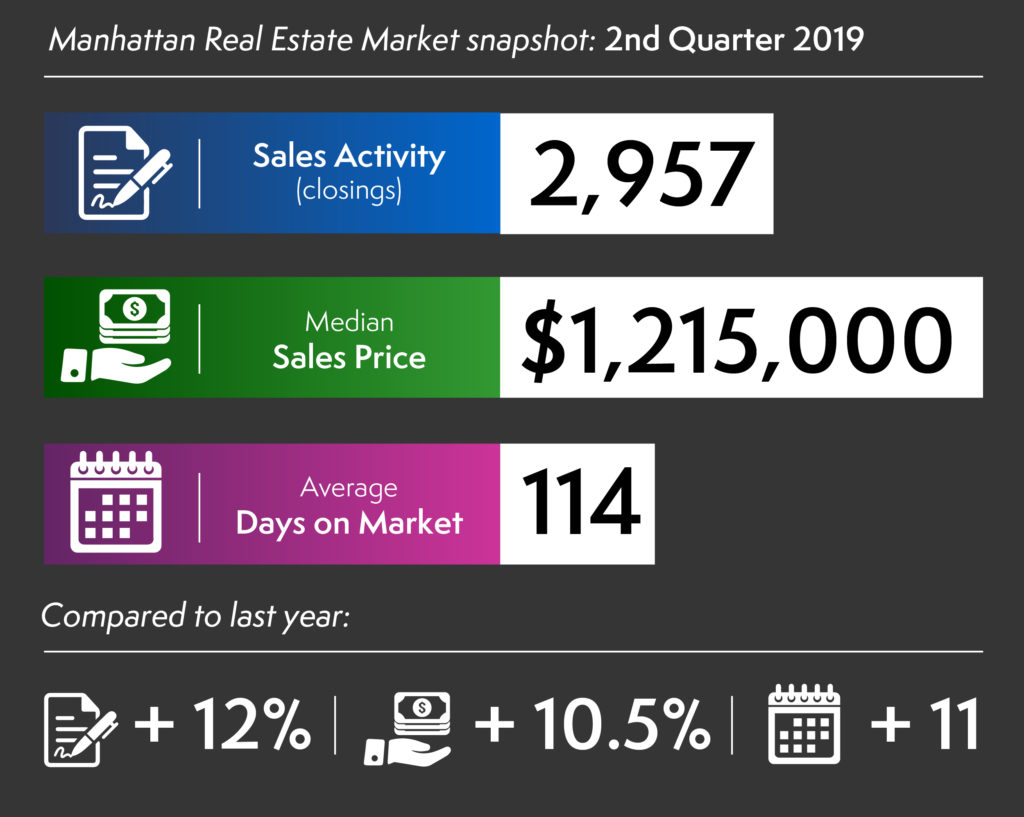

Overall sales activity through all categories was up over 12% YoY with 2,957 closings, also spurred by mortgage rates that were on average 3 quarters of a percent lower than the same period last year. The good trend in the financial markets early in 2019 helped many in making their buying decision in the first quarter of 2019 with related closings that happened in the second quarter.

The median sales price jumped 10.5% to $1,215,000 after hovering around the $1M mark for a few years. The average sales price went up 0.2% to right under $2.1M and the average price per square foot went up 1.7% to $1,762, always YoY.

Despite the increase in sales, listing inventory (number of available homes) increased 8.2%, the 7th straight increase and 20% higher than the ten year quarterly leverage. This is the most meaningful data which indicates that a buyer’s market is likely to continue, at least in the near future.

For those of you in the market for a two bedroom apartment: you will be delighted to know that inventory increased almost 15% in this category, double the rate than other apartment size categories, so get ready for expanded options!

But Manhattan is always Manhattan and bidding wars are still going on. 5.7% of all transactions closed at a higher price than the last asking price. While the rest of the sales closed on average 5.9% below the last asking price, we will call this the negotiability factor. The absorption rate fell to 7.7 months thanks to increased sales activity while the days-on-market metric went up 11 days to 114 days from a year ago.

Share

SEP

2019