Finally after two years of low volumes in the sales market, the first quarter of 2020 showed an increase in closings as sellers became more realistic about pricing.

It must be said that this trend, given it is based on closed sales, doesn’t fully reflect the most recent changes of the market conditions related to the coronavirus pandemic.

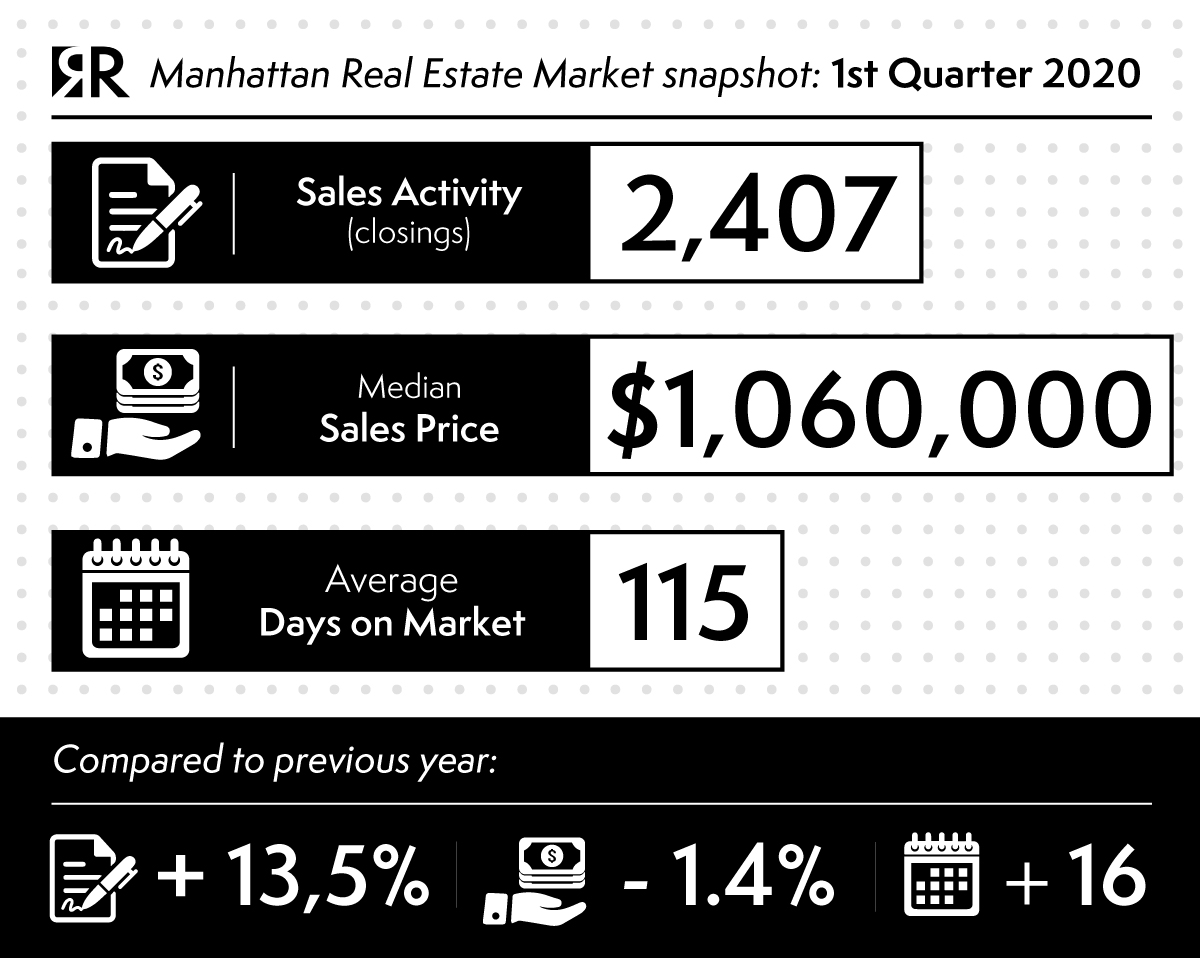

Let’s see the numbers:

The first quarter of 2020 started with a 13.5% year over year jump in the number of sales to 2,407. Median sales price loss 1.4% to $1,060,000 from the prior-year quarter. Because the decline in activity skewed toward the high-end of the market, the average sales price decreased 10.9% to $1,887,740, and the average price per square foot fell 12.9%. Listing discount rose to 7.2% from 6.9% in the prior-year quarter, tying the amount reached in the third quarter of 2012. The increased negotiability primarily reflected the willingness of sellers to travel farther to meet the buyers on price. Days on market followed a similar pattern as older inventory was cleared from the market as sellers grew more negotiable. This average number of days to sell all apartments that closed during the quarter was the highest seen in five years, slowing by 16 days to 115 days from the year-ago quarter. With the year over year 13.5% rise in sales and 8.4% year over year decline in listing inventory, the first decline during this period since 2007, the pace of the market moved slightly faster. The months of supply was 7.6 months, 1.8 months faster than the year-ago pace.

The most critical metric in March has been falling listing inventory trends. This 8% decline during this period indicated that would-be sellers became more reluctant to join the market, given the uncertainty arising from the coronavirus outbreak.

The short-term perspective for the Manhattan housing sales market is based on how long sellers and buyers think it will take for the pandemic to decrease.

(source: Miller Samuel Inc.)

ShareAPR

2020